How will SARS potentially collect data to verify compliance of the taxpayer for Solar panels incentives?Tax Incentives for Individuals who invest in renewable energy in South Africa

Solar panel incentive for individuals

A Draft Taxation Laws Amendment Bill (initial batch) was published which proposes an insertion of section 6C "solar energy tax credit" in line with the announcement by the Finance Minister to introduce a tax incentive for individuals to invest in renewable energy.

Qualifying criteria:

- The credit will be available only to natural persons,

- for new or unused solar photovoltaic panel with generation capacity of each not less than 275W, brought into use by the natural person on or after 1 March 2023 and before 1 March 2024.

- The solar panels must be installed and mounted on a residence mainly used for domestic purposes.

- The installation must be connected to the distribution board of the residence with an electric certificate issued to the natural person in respect of the installation.

How much is the credit?

The credit as announced during the 2023 Budget speech is limited to 25% of the cost of the solar panels and cannot in aggregate exceed R15 000.

Where you and your partner split the cost of the Solar panels can you both claim up to R15K?

Where the cost of the solar is split the tax credit must be apportioned with the deduction for the total cost limited to 25% of the total cost of the solar panels of R15K whichever is higher. An example where the cost is shared 50% and total cost was R150K.

25% of 150K =R37.5K therefore higher than 15K the tax credit for the residence is therefore limited to 15K. The partners in the determination of their respective taxable income can claim a tax credit of R7.5K each.

How will SARS potentially collect data to verify compliance of the taxpayer for Solar panels incentives?

As indicated above, to be able to claim this rebate an individual needs to have a valid invoice and certificate of compliance indicating that the panels were brought into use for the first time in the period from 1 March 2023 to 29 February 2024.

The taxpayers will be able to claim the rebate on assessments during the 2023/24 tax filing season. Provisional taxpayers will be able to claim the rebate against provisional and final payments.

The installers will be required to submit third party returns with the cost of the solar panels, physical address of the taxpayer where installation took place and date on which the solar panels are brought into use after installation, income tax reference number or identity number for solar PV panels that were brought into use for the first time between March 1, 2023, and February 29, 2024, by May 31, 2024.

Understanding tax incentives and other benefits of using renewable energy in South Africa (Business)

The government announced renewable energy related tax incentives in February 2023 to assist businesses and consumers alike as they attempt to mitigate the destruction brought about by loadshedding.

Recently the National Treasury published a draft bill for commentary detailing how the incentive will be applied. In this article we comment on existing incentives and other benefits currently available to taxpayers. We also summarize the contents of the draft bill.

Tax incentives for businesses involved in generation of electricity.

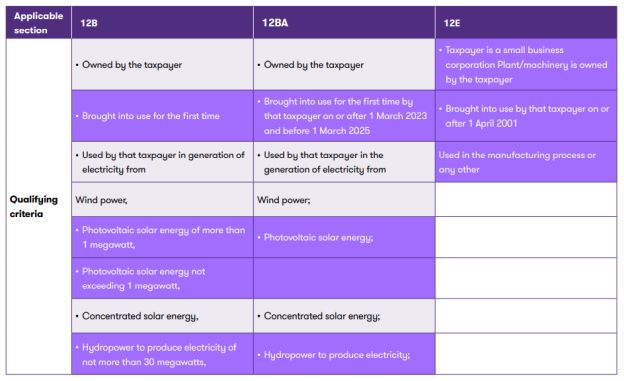

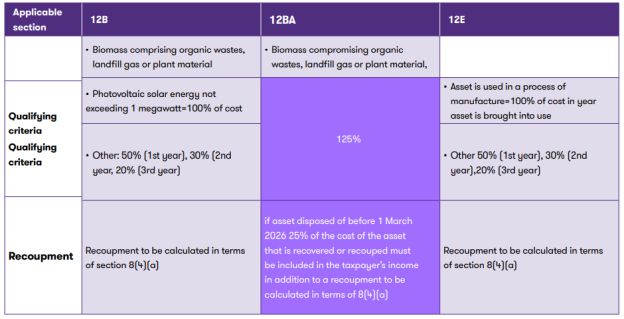

The draft bill proposes that section 12BA is added to the Income Tax Act No.58 of 1962. This section will allow qualifying businesses to claim 125% of costs incurred in respect of qualifying investments.

This is limited to investments brought into use for the first time between 1 March 2023 and 28 February 2025. There will be no thresholds on the size of the projects that qualify, and the incentive will be available for two years to stimulate investment in the short term. Below we compare the incentive per the draft bill to existing incentives that businesses can apply to similar projects/ assets.

1 Small business cooperations are defined to be a personal liability company, close corporation, or private enterprise. The entity's shares (proprietary interests) must be held by natural people at all times during the assessment year and the gross income of the entity may not exceed R20,000,000.

Energy consumption- Section 12L

Section 12L of the Income Tax Act provides for an additional allowance for energy efficiency savings. The deduction of the energy efficiency savings is calculated at 95 cents per kilowatt hour or kilowatt hour equivalent. Before making a deduction under section 12L during any year of assessment, the taxpayer must have a certificate from South African National Energy Development Institute (SANEDI) that confirms and provides proof of energy savings in their possession

Carbon Tax/Excise

Renewable energy premium

Eskom and other electricity generators who during the tax period purchased renewable energy at a price inclusive of the renewable energy premium under the Renewable Energy Independent Power Producer tariff are the only ones who are eligible to use the provision in Section 6(2) of the Carbon Tax Act, 2019, which allows the deduction of the Renewable Energy Premium against the taxpayer's carbon tax liability.

The carbon taxpayer must meet the following requirements to be eligible for the deduction:

- Be licensed with the National Energy Regulator of South Africa (NERSA); and

- Supply electricity to the national grid with a Purchasing Power Agreement (PPA) with Eskom.

The carbon tax liability may only be offset by direct and primary purchases of renewable energy for which the renewable energy premium was paid. Therefore, the deduction is only available to carbon taxpayers who are producing electricity and who really paid the premium for renewable energy on those purchases made during the tax period.

For the carbon tax purposes, some items are not eligible for the renewable energy premium deduction depending on the purchase, use, disposal of such renewable energy.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.